Maximizing Yield with Factorial

TLDR

New Markets Unlocked: Higher leverage, higher stakes. For users who like their yields boosted and their risk tolerance tested.

Looping Strategies: Repeated borrowing and reinvesting to maximize returns through compounding yields.

TON Incentives Expanded: TON incentives continue and now include borrowers utilizing USDT-SLP collateral.

Efficacy of Isolated Pool

An isolated pool maintains seperate liquidity pools for each asset pair, unlike traditional multi-asset lending pools where multiple assets share liquidity and associated risks. This isolation optimizes risk management for asset pairs and prevents risk contagion from unrelated asset incidents.

Risk optimization

Each market on Factorial is configured with distinct parameters such as maximum risk/leverage ratio, liquidation threshold, and interest rates tailored to the unique risk profiles of individual assets. For instance, investors lending USDT against TON may have varying risk tolerance towards TON’s volatility. Isolated pools accommodate these diverse risk preferences effectively.

Easy asset onboarding

The isolated pool structure enables effortless onboarding of new assets without impacting existing markets, providing users with a broader range of choices while effectively managing risks. In contracts, integrating new collateral in a single multi-asset pool would require broader consensus from existing users, complicating the onboarding process.

Introduction of New Markets

Advanced Pool

Advanced pool offers users greater leverage than the existing Basic pool, which supports TON, USDT, and LST(tsTON and stTON) as collateral and borrowing assets. Users benefit from enhanced capital efficiency though at the cost of higher liquidation risks. Designed for investors with aggressive risk profiles, the Advanced pool demands careful monitoring due to increased sensitivity to market volatility.

Storm Trade Pool

Factorial now supports Storm Liquidity Provider (SLP) tokens-representing liquidity provided to Storm Trade-in isolated pools. These pools enable leveraging SLP tokens (USDT-SLP and TON-SLP) to enhance yield returns without introducing additional risks to existing markets.

Since these new pools do not share liquidity with existing pools, lenders wishing to participate must manually move their liquidity. To streamline this process, Factorial employs a Vault layer. Liquidity deposited into Vaults is dynamically allocated across markets based on real-time demand. This approach minimizes idle liquidity, benefiting lenders with higher returns while providing borrowers with stable and lower borrowing costs. For more detailed information on Vaults, please refer to the following article.

Leveraging Strategies

Looping is a strategy designed to maximize yields by repeatedly leveraging asset. Users supply a yield-generating asset (e.g., liquid staking tokens, LP tokens) as collateral, borrow a stablecoin or TON against it, then swap it back into the original yield-generating asset. This newly acquired yield-generating asset is again supplied as collateral, repeating the cycle multiple times to amplify the leveraged position and maximize returns.

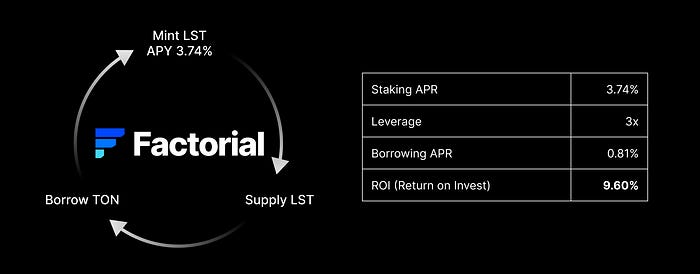

LST Looping

LST (Liquid Staking Token) looping strategy captures high staking yields while maintaining TON exposure. For instance, a leveraged tsTON/TON position enhances staking returns without amplifying direct TON price risk, as debt is denominated in TON.

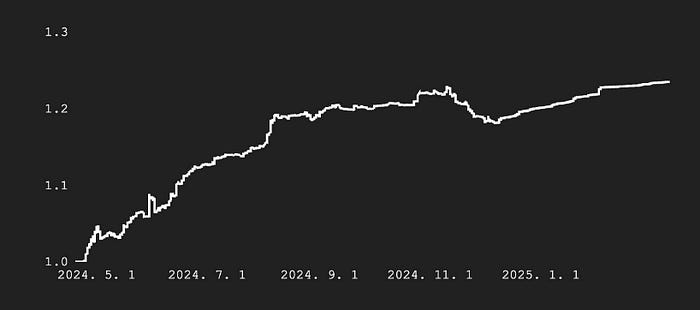

Yield from TON liquid staking tokens is typically realized via token price appreciation. Given historical staking yields around 4%, leveraged positions remain manageable if borrowing costs stay below this rate, significantly mitigating liquidation risk barring extraordinary circumstances like slashing events.

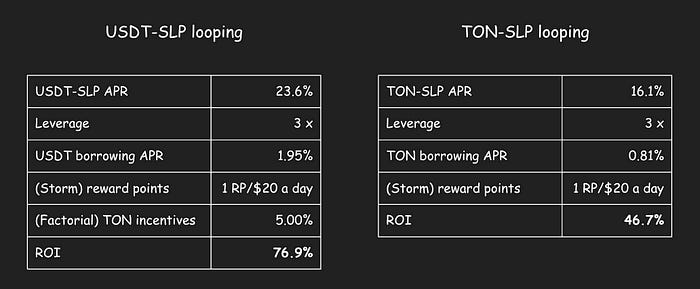

SLP Looping

Storm LP tokens (SLP) provide liquidity to Storm Trade, acting as counterparties to perpetual traders. Storm Trade accepts assets such as USDT, TON, and NOT, enabling users to trade various perpetual futures. Liquidity providers (LPs) receive 70% of the generated trading fees.

Therefore, SLP values depend on:

Underlying token prices (USDT, TON, NOT)

Trading fees generated from the market

Traders’ profits and losses (PnL)

Historically, SLP tokens exhibit strong risk-adjusted performance, largely due to effective trading and risk management.

Factorial integrates Storm Trade, launching new markets accepting USDT-SLP and TON-SLP as collateral. Specifically, there will be markets mapping USDT-SLP collateral to USDT loans, and TON-SLP collateral to TON loans, enabling optimized risk management.

Users can now leverage yield through SLP, similar to LST looping strategies. Additionally, Factorial’s TON incentive program now extends to USDT-SLP collateral, reducing borrowing costs. Users participating in USDT or TON vaults via SLP benefit from both protocol fees and additional Storm Trade reward points.

Higher returns inevitably come with higher risks. Although SLP typically offers superior yields, it also carries increased liquidation risk due to trader PnL exposure. Factorial applies an additional DeFi risk factor beyond underlying asset risks and sets conservative leverage limits (approximately 3x).