Maximize Yield with Confidence

A Closer Look at SLP in Factorial

TLDR

SLP holders earn trading fees, but they may also absorb losses when traders profit.

In TON-based markets, liquidation is driven by SLP-to-TON ratio, not by TON’s price volatility.

More trades mean more yield, but also more risk. Factorial sets conservative limits, but users should still manage exposure wisely.

Since launching the SLP Looping Pools, Factorial has seen over $3 million worth of SLP — across both SLP-USDT and SLP-TON — supplied in just 10 days. As interest in leveraging SLP grows, so does the need to better understand the risks involved. Many users are now looking beyond returns, seeking clarity on what could go wrong and what to consider when using SLP as collateral.

This article aims to address those questions. It provides a detailed breakdown of the risks associated with SLP and offers guidance to help users make more informed, responsible decisions.

If you’re unfamiliar with the looping strategy using SLP, we recommend starting with our previous blog post.

For a step-by-step walkthrough of how to execute SLP Looping on Factorial, refer to the official documentation.

SLP Fundamentals : A Concise Overview

On Storm Trade, SLP (Storm Liquidity Provider) tokens represent shares of liquidity pools that act as counterparties to perpetual traders. Traders open leveraged positions using SLP liquidity, meaning that traders’ profits and losses directly impact the value of SLP. When traders lose, SLP holders profit; when traders win, SLP holders absorb the loss. Additionally, trading fees are distributed to SLP holders, creating a yield-bearing structure.

Types of SLPs:

USDT-SLP: Backed by USDT deposits, it caters to traders who prefer stablecoin-based margin trading. Yields accumulate in USDT, offering relative stability due to its peg to the U.S. dollar.

TON-SLP: Accepts TON as collateral and liquidity, catering to traders who prefer native TON-based margin trading. Since fees are also earned in TON, TON-maxi holders may choose this vault to grow their TON stack. The structure is similar to LSTs, but the yield tends to be more volatile.

Understanding the Risks Behind the Yield

SLP holders are exposed to several key risks:

Asset Price Risk: The value of deposited assets (e.g., TON or NOT) is subject to market volatility. A decline in these asset prices directly reduces the value of SLP.

Trader Profit and Loss (PnL): SLP value is directly affected by trader performance. When traders earn profits, it reduces SLP value; conversely, trader losses increase SLP returns.

Liquidity Risks: High withdrawal demand or poor market conditions may impact the ability to redeem SLP promptly.

Smart Contract Risk: Potential vulnerabilities or exploits in the smart contracts managing the Vault could lead to loss of funds.

Understanding these risks thoroughly is essential for users aiming to provide liquidity via SLP on Storm Trade.

SLP as Collateral: How Factorial Evaluates the Risk

Factorial has launched two isolated markets enabling leverage of SLP tokens: one market allows borrowing USDT against USDT-SLP, and the other permits borrowing TON against TON-SLP.

To collateralize SLP effectively, we must thoroughly assess its risk profile. Below, we examine how previously outlined risks associated with SLP tokens impact on our platform.

Asset Price Risk

Asset price risk arises from fluctuations in the underlying assets — USDT or TON. TON-SLP is denominated in TON, resulting in higher USD-value volatility but relative stability in terms of TON.

Factorial minimizes this risk by separating markets based on the underlying asset. Collateral and borrowed assets are matched 1:1 (e.g., USDT-SLP/USDT, TON-SLP/TON), meaning price volatility impacts both sides equally — greatly reducing liquidation risk from asset price movements.

Trader PnL Risk

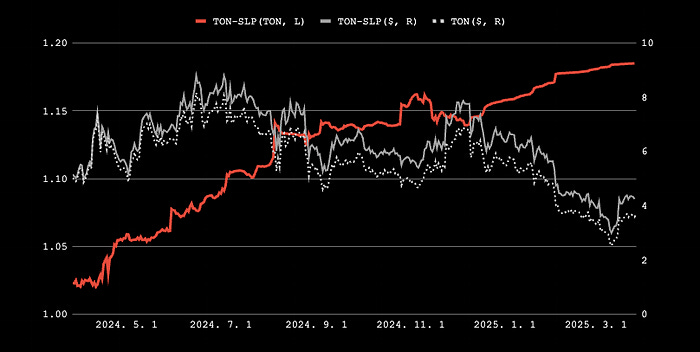

SLP tends to appreciate steadily as it accrues trading fees from its role as a counterparty to margin traders. However, short-term declines may occur when trader profits become unusually concentrated over a short period. This typically happens when market sentiment aligns strongly in one direction — such as during a sharp rally — and traders happen to be correct.

Historical data from Storm indicates clear periods of heightened trader profitability during strong market trends, directly impacting SLP performance.

Based on the risk management policies of Storm Trades, we conservatively assume the maximum potential loss from trader PnL to be around 15%. This estimate is based on the maximum trading capacity of traders relative to SLP liquidity, and the peak daily volatility of traded tokens like BTC and TON.

15% (Max Potential Loss) = 30% (Max Open Position) × 50% (Daily Volatility of the trading token)

While our estimate is intentionally conservative, the likelihood of such extreme losses materializing is relatively low in practice. Storm Trade implements several guardrails — such as funding fees to discourage imbalanced positioning and PnL cap to limit maximum trader gains, and a liquidity buffer that sets aside platform revenue to help offset trader profits. Liquidity buffer can further mitigate downside risk for SLP holders. For more details on this mechanism, refer to their article. Still, we apply this worst-case scenario framework to ensure we understand the outer bounds of potential risk and are prepared accordingly.

Should Storm Trade modify any of these parameters — whether loosening caps, adjusting limits, or introducing new risk policies — we will reassess the collateral risk of SLP accordingly. We maintain close communication with the team and actively monitor protocol updates. If such changes, or broader shifts in market conditions, lead us to conclude that the risk profile of the asset has materially changed, we will promptly update our risk parameters to reflect the new environment.

Liquidity Risk

This refers to the risk of not having enough liquidity during a liquidation event or sudden user withdrawals. If liquidators struggle to unwind SLP position quickly, effective liquidation could become challenging, increasing the risk of bad debts for lenders.

Storm mitigates this through strong liquidity controls : open interest limits, PnL caps, and circuit breakers that help preserve reserves. SLP holders can also withdraw funds at any time, maintaining flexibility.

How to Boost SLP Yield in Factorial

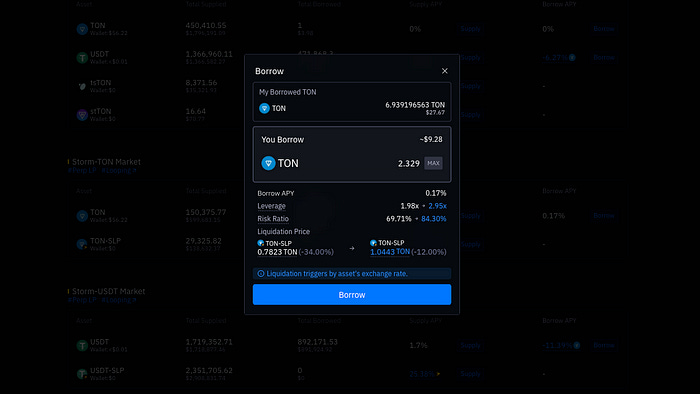

When initiating a loan against SLP, users will see various risk indicators like the following.

Leverage and Risk Ratio help assess the health of a position. These metrics are pool-specific and subject to maximum limits. If the value of the collateral asset — like SLP-TON — falls below a threshold or interest accumulates, the position may cross the pool’s limit and become liquitable.

This threshold is displayed as the liquidation price, which reflects the SLP exchange ratio. In the example shown above, since both the collateral and borrowed asset are TON-denominated, USD value of TON doesn’t impact the position. Only the SLP-to-TON ratio matters.

The ratio declines when traders on Storm Trade are consistently profitable, typically during strong market trends. Investors in Factorial should maintain prudent leverage levels to avoid liquidation risk. While higher trading volumes bring in more fees, they also increase the pool’s potential losses.