Introducing Vault & Vault Manager

TLDR

Vaults streamline DeFi investing, automating yield strategies while ensuring user control.

Vault Managers offer custom investment strategies, allowing users to define risk and optimize returns.

Designed for flexibility and security, Vaults provide seamless DeFi access without manual management.

Vault is an advanced, permissionless lending protocol built on top of Factorial Finance. By combining the strengths of isolated and multi-asset pools, Vault enhances the lending experience, providing users with an efficient and streamlined solution. Over time, Vault will become the natural choice for users in TON ecosystem seeking passive yield.

This article explores why Vault and Vault Manager are essential components of Factorial.

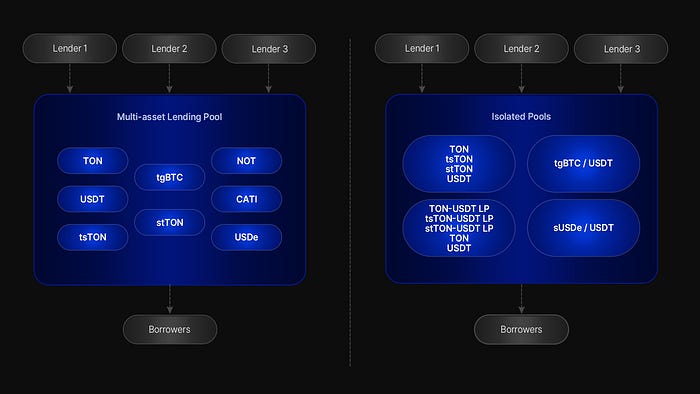

Isolated Pools

Factorial employs isolated pools, where each pool operates independently. Isolation offers key advantages :

No cross-collateralization surprises: Each pool’s collateral remains separate, preventing unexpected interactions.

No hidden correlation risks: Problems in one pool do not affect others.

No market contagion: Issues in single lending market are contained, avoiding systemic disruptions.

Multi-asset lending pools offer strong advantages in terms of convenience and capital efficiency, but they come with the inherent drawback of risk intermixing among assets. Recognizing the importance of user security, Factorial implemented isolated pools to mitigate these risks.

However, Factorial also aimed to retain the benefits of traditional lending models. To achieve this, we introduce Vaults as an additional layer. Vaults enhance user experience, improve capital efficiency, and cater to diverse risk preferences, ensuring a lending environment that is both secure and optimized for different user needs.

Abstracting Lending Experience

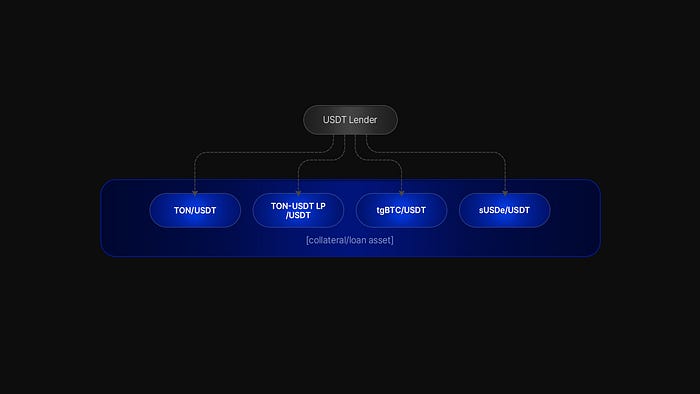

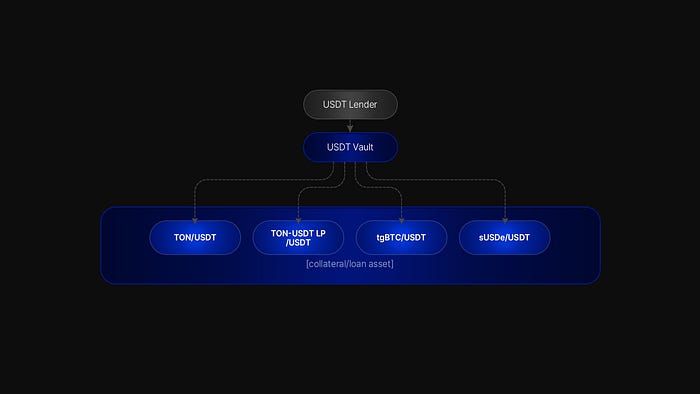

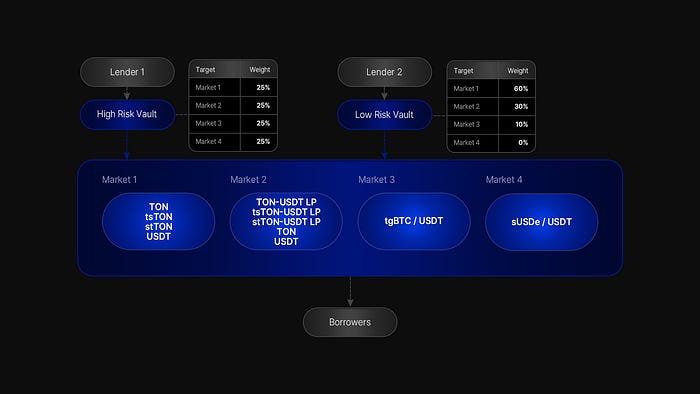

Isolated pools provide multiple lending options for the same asset. For example, Factorial might offer USDT lending in markets like TON/USDT, LP token/USDT, tgBTC/USDT, and sUSDe/USDT. Then users must either determine which pool offers the best conditions or split their funds across multiple pools, adding complexity. Additionally, if the interest rate of their chosen pool declines over time, they may need to manually reallocate funds to a different pool to optimize returns.

Vaults simplify this complexity by providing a single point of entry. Vault Managers allocate liquidity across whitelisted markets, dynamically adjusting funds based on supply and demand. This approach:

Improves user experience: Users no longer need to monitor individual pool risks and allocations.

Optimizes yields: Vault Managers rebalance liquidity to maximize lender returns.

Vaults combine the simplicity of multi-asset lending pools with the advantages of isolated markets, ensuring an optimal experience for users.

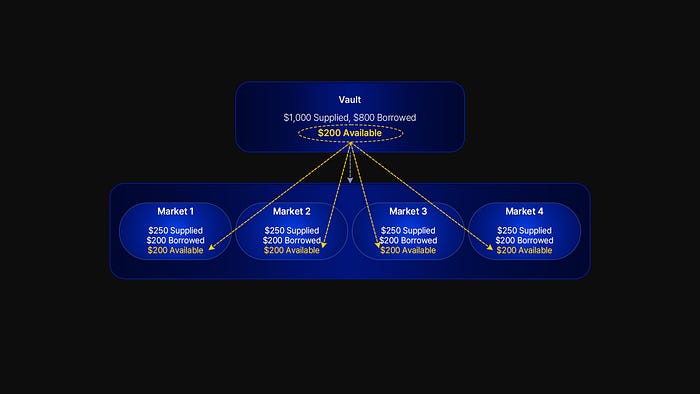

Amplifying Liquidity

Liquidity fragmentation can limit capital efficiency. For example, if a pool operates at 80% utilization, capital spread across multiple pools significantly reduces available liquidity. From a borrower’s perspective, this reduces utility, as fragmented liquidity may lead to higher borrowing costs, reduced loan availability, and increased difficulty in securing optimal lending terms.

Vaults mitigate this issue by responding dynamically to liquidity demands. They preserve risk isolation while ensuring efficient capital allocation across multiple pools. When lending activity increases in a particular market, Vaults adjust liquidity distribution accordingly, improving overall market depth.

Embracing Diverse Risk Profile

Vaults cater to different risk appetites, offering a tailored lending experience. Even when lending the same asset, such as USDT, lenders have varying preferences along the risk spectrum:

Risk-seeking lenders: Those willing to take on higher risks in pursuit of greater returns.

Risk-averse lenders: Those who prioritize security and stable yields.

Vault Managers optimize lending strategies by adjusting target weight allocations among lending markets. This approach allows users to fine-tune their exposure to various markets based on their risk tolerance, fostering a more inclusive and scalable lending environment.

Role of Vault Managers

Vault Managers serve critical functions by providing professional oversight in:

Risk Curation : Helping users navigate dynamic market risks with tailored strategies.

Portfolio Optimization : Identifying optimal yield opportunities while maintaining transparency.

As markets evolve, risk conditions fluctuate. Vault Managers actively monitor and adjust portfolios rather than relying solely on automated liquidity distribution. By managing risk and optimizing returns, they enable users to simply deposit funds and let the Vault handle the rest, removing the need for constant market monitoring and manual adjustments.

The governance framework ensures that decision-making remains entirely within vault. Once an agreement is established between owner and the manager, external parties have no control over the governance of the vault. This structure ensures that all decisions are aligned with the interest of the vault’s participants.

A New Standard for DeFi

Vaults empower users by expanding their choices and simplifying participation. By leveraging the expertise of Vault Managers — financial professionals who actively manage risk and optimize returns — users can engage in lending without the complexity of constant oversight. Vault Managers operate in a transparent marketplace, ensuring efficient capital management aligned with user interests.

Looking ahead, Factorial is committed to advancing DeFi by:

Expanding Vault Manager capabilities such as swaps and borrowing, enabling more diverse and sophisticated strategies.

Enabling permissionless lending pool & Vault creation to foster open participation and competition.

Integrating RWA and BTC, to expand yield-generating opportunities and enhance the potential for comprehensive services.

Factorial is building the foundation for a DeFi ecosystem that prioritizes user empowerment, transparency, and professional-grade services. By integrating mass-accessible technology with high-quality solutions, we aim to push the boundaries of DeFi and drive broader adoption.