Factorial’s Incentive Program : Earn while you Borrow

TLDR

TON Rewards powered by Factorial are live — if you’re borrowing USDT, you’re in

Chasing TVL for the sake of TVL? That’s how you build a DeFi Ponzi, not a protocol

More features are coming — More collaterals, Factorial Pro, and Power Account

False Belief in TVL

A common misconception in DeFi is that a higher TVL (Total Value Locked) automatically means greater utility. While TVL is often used as a success metric, its actual significance depends on the project — many fail to recognize that TVL alone does not determine real effectiveness.

For example, in AMM DEXs, Uniswap v3 concentrated liquidity provide better trading conditions than Uniswap v2 with far less liquidity. In lending, TVL represents available liquidity, but without borrowers, those assets generate no revenue. In both cases, TVL alone is a vanity metric unless it translate into real usage.

Despite this, many projects blindly distribute incentives, attracting liquidity without ensuring real engagement. This fuels TVL inflation, where mercenary capital temporarily pumps numbers, only to vanish when rewards stop. The result? False growth, liquidity shocks, and unsustainable yield expectations, making it harder for protocols to build a stable user base.

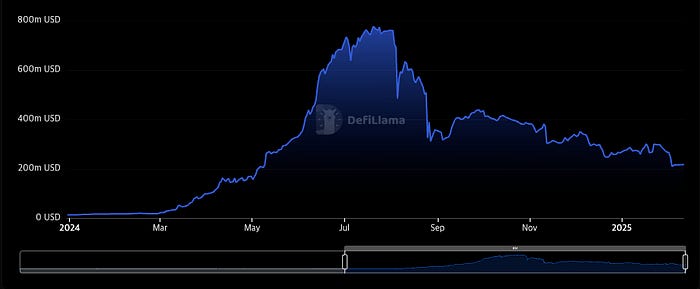

Think back to summer 2024, when a flood of incentives hit the TON ecosystem. The moment rewards stopped, so did the liquidity. This unsustainable farming cycle is exactly what Factorial aims to avoid.

This raises a key question: how can we design an incentive program that attracts real, engaged users rather than temporary liquidity? To answer this, we first examine the distinct behaviors of lenders and borrowers — who truly contributes to a protocol’s long-term sustainability, and where should incentives be focused

Finding a Sustainable User Base

While both lenders and borrowers contribute to the lending protocols, their behaviors and decision-making processes differ in meaningful ways.

Lenders tend to prioritize steady income. Rather than being loyal to a particular platform, they are highly sensitive to immediate yield opportunities. Even when receiving attractive incentives, they remain open to switching if better options arise. As a result, they are not tied to certain protocol or network and will readily move liquidity when condition shift.

Borrowers, on the other hand, are more speculative investors, seeking high upside opportunities rather than immediate returns. Since they maintain their positions until they close them, their engagement with a borrowing platform naturally lasts for a longer period. While borrowing costs matter, user who prioritize user experience may continue using a platform they find more convenient — even if costs are slightly higher.

Understanding these dynamics is key to designing an effective incentive program. Rather than simply attracting liquidity from lenders, the goal should be to build a strong base of active borrowers who contribute to both the protocol and the broader TON ecosystem in a meaningful and sustainable way.

Factorial’s Incentive Program

Factorial’s incentive program introduces two reward schemes to incentivize USDT borrowing: TON Rewards powered by Factorial (our official TON farming program) and a point-based farming system.

How It Works:

Daily Snapshots: Rewards are calculated from snapshots taken at regular daily intervals.

Reward Structure:

TON Rewards powered by Factorial: Earn TON incentives for borrowing USDT against TON-related assets.

Point-Based Farming: Collect points for participating. This program rolling out after TON grants.

The program will initially focus on USDT borrowing with TON-related collateral, excluding stablecoins. Borrowing volume is the primary factor in reward allocation, but as eligible collateral expands, incentive distribution will adjust accordingly. The addition of new markets and changes in reward allocation will be strategically revised based on market dynamics and policy decisions.

Expected Impact

Investors can use borrowed USDT from Factorial to explore yield-generating opportunities or invest in other assets. These funds are expected to play an active role in various activities within the TON ecosystem.

Factorial is actively collaborating with DEXs, yield protocols, and other DeFi partners to enhance liquidity and utility across the ecosystem. Through this reward program, Factorial aims to strengthen the TON DeFi landscape by increasing capital efficiency and fostering deeper integrations. Additionally, as new assets like USDe and BTC enter the ecosystem, Factorial will facilitate seamless integrations to ensure smooth capital flow.

Rather than driving short-lived liquidity surges, Factorial’s structured incentives and advanced architecture are designed to promote sustainable DeFi growth and long-term stability. This program will build to encourage real, value-driven participation within the TON ecosystem.

What’s Next

Factorial is continuously evolving to unlock more opportunities and enhance the user experience. Key upgrades are on the way to expand market offerings and facilitate yield strategies.

Factorial v2 upgrade will include:

Support for advanced yield strategies, including flash loans and one-click looping.

Tools specifically designed for power users engaging in complex DeFi strategies.

Delegation features, allowing users to assign portfolio optimization to experts

New market offerings, including USDe and BTC, are expected to introduce additional yield opportunities, contributing to the broader expansion of the TON DeFi ecosystem. These upgrades aim to enhance flexibility and efficiency, providing potential benefits for both retail and advanced users.