Factorial Architecture

Simple UX, Infinite Flexibility

TLDR

Factorial transforms DeFi lending into a DIY playground, allowing users to create custom lending pools with flexible risk and interest parameters.

Risk stays contained, as isolated pools ensure asset volatility or failures remain limited to individual pools.

DeFi made simple, with abstracting complex mechanics into seamless, automated processes while keeping users in full control.

Factorial Finance is designed to be a gateway for simplified yield services. By focusing on accessible and flexible lending and borrowing of assets, Factorial aims to establish a base layer for a variety of yield-generating opportunities across multiple ecosystems.

1. Why we built Factorial

The rapid evolution of DeFi lending since the launch of Compound over five years ago has brought significant innovation, yet user adoption remains limited.

Current lending protocols fall short in several critical areas:

Weak Distribution Channels : Complexities of on-chain activities, including wallet management and gas fees, present barriers for retail users and deter widespread adoption.

UX Challenges : As financial functionalities become increasingly sophisticated, users without specialized knowledge often struggle to navigate and fully utilize DeFi services.

Limited Customization : Offer a narrow range of assets and enforce a one-size-fits-all risk-return profile, leaving little room for tailored solutions.

Factorial addresses these challenges by redefining DeFi lending as a protocol for trustless portfolio optimization. Our vision is to create a fully autonomous, user-centric system that bridges the gap between technical sophistication and accessibility, opening DeFi to a broader and more diverse audience.

2. What is Factorial

Factorial is an efficient and modular platform that enables seamless access to a diverse range of users with minimal effort, making it an ideal foundation for innovative DeFi applications.

Native on TON

Factorial, built on TON ecosystem, is seamlessly integrated into the Telegram. With over 1 billion active users, Telegram provides an unparalleled distribution channel, allowing users to easily deposit or borrow assets directly within a platform they already use.

Simplifies User Experience

Factorial simplifies complex DeFi operations by turning intricate workflows into intuitive processes. Its secure and transparent framework allows users to delegate assets without requiring trust, enabling professional-grade strategies with full visibility and peace of mind.

Limitless Flexibility

Factorial’s modular design enables users to create and manage custom lending pools and vaults tailored to specific needs and risk frameworks, fostering innovation and diversity in the ecosystem. The protocol’s core infrastructure is immutable, ensuring trust and security for all participants while maintaining decentralization at its foundation.

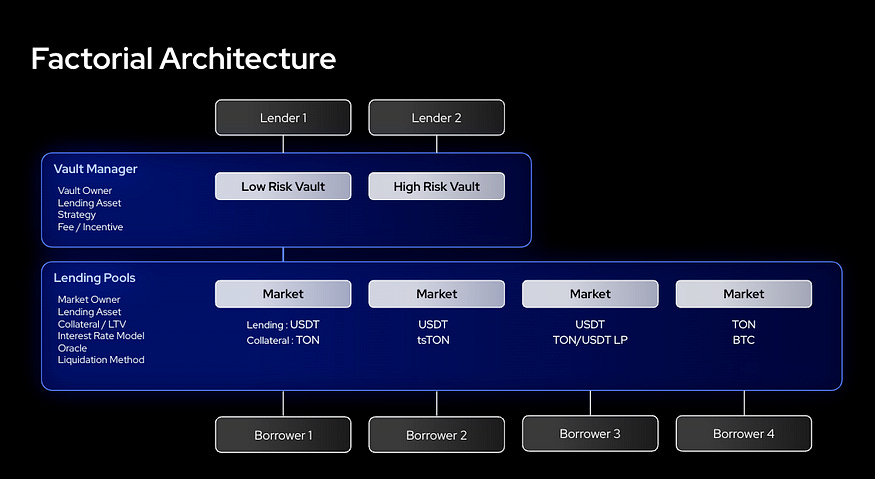

3. Factorial Architecture

Factorial’s architecture is designed to translate its vision into practical, user-centric functionalities, ensuring flexibility, security, and efficiency in every interaction.

Isolated Pool

Each lending pool operates independently, containing risks within its boundaries. This architecture allows each asset to have a tailored risk policy optimized for its unique characteristics, enabling a wide variety of assets to be incorporated onto the platform and offered as options to users. Additionally, it facilitates seamless integration with external DeFi protocols without introducing systemic risks.

Pool Factory

Factory allows for the permissionless creation of highly customizable and credible liquidity pools. Pool owners have the flexibility to define collateral and loan assets, interest rate models (IRM), oracles, and risk frameworks. This high degree of freedom enables users to respond dynamically to the diverse demands of various asset markets, fostering innovation and adaptability within the ecosystem.

Vault

Vault simplifies the user experience by abstracting the complexities of isolated pools. Vault Managers can implement custom rules, catering to diverse risk profiles. Additionally, the vault ensures liquidity rebalancing and yield optimization, maximizing utilities while maintaining user control and transparency.

Power Account

Power Account is a personalized yield-generation tool that support advanced yield strategies, including flash loan. It also allows users to delegate to managers, offering a “vault curator” experience for tailored yield-generation execution. It will be introduced in the next version, opening the door to innovative and customized yield-generation opportunities.

4. What’s Next?

Factorial is designed as a trustless and permissionless system, where all functionalities operate with decentralization at their core. However, until we are fully confident in the stability and security of the code and system, all vaults and pools will initially be created and managed by the Factorial team and trusted partners. This temporary approach ensures your assets remain safe while we build a robust and secure foundation. Third-party vault and pool creation will be enabled and announced once the system matures.

As the liquidity layer for TON ecosystem, Factorial lays the foundation for a diverse ecosystem of applications that can offer tailored yield-generation products, enhance usability, and provide innovative solutions. Users can seamlessly interact with these primitives, aligning with their specific needs. With these advancements, Factorial is not only driving the evolution of decentralized finance on TON but also setting a new standard for security, efficiency, and user-centric design in the DeFi space.