DeFi Evolution

Learning from the Past, Innovating the Future

DeFi Summer : Boom and Bust

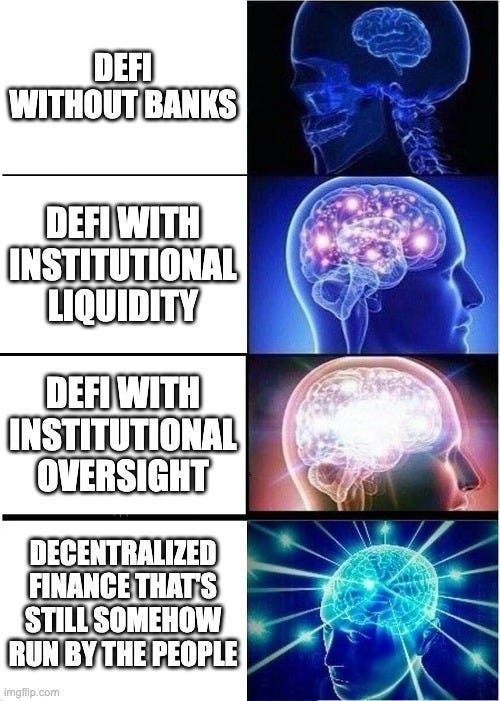

DeFi, or Decentralized Finance, emerged as a blockchain-powered alternative to traditional finance with a bold mission: to cut out the middlemen — goodbye, banks — and put control directly into the hands of users. By leveraging blockchain technology, DeFi delivers greater efficiency, transparency, and decentralization, empowering users to access financial services on their terms.

DeFi Summer ignited with Uniswap, whose innovative Automated Market Maker (AMM) turned anyone into a liquidity provider. No finance degree? No problem. Uniswap’s AMM let users contribute liquidity and earn trading fees with nothing but a few clicks. Similarly, Compound introduced algorithmic lending and borrowing, launching DeFi’s lending and yield markets. This wasn’t just another savings account — it was an entirely new way to earn returns in the crypto world.

The Holy Grail

DeFi is driven by values and principles that go beyond code and charts. The principles of DeFi that stand as its “holy grail” are as follows :

Decentralization: Authority rested with the participants, not with central controllers. Finally, users felt they had real power.

Transparency: Every transaction was public, visible on the blockchain, leaving no secrets and creating trust like never before.

Permissionless Access: No approvals, no restrictions — just anyone with an internet connection diving in and taking part.

Interoperability: Protocols worked together seamlessly, like pieces in a much larger puzzle, allowing users to move between platforms freely.

Accessibility: For the first time, financial services seemed open to all, with no borders, no economic discrimination.

In those early days, DeFi wasn’t just technology; it was a movement carrying everyone forward toward a future of true financial freedom.

As DeFi fever spread, the space burst into a frenzy of activity. New protocols popped up nearly every day, and liquidity flooded in from investors eager to be part of what some dubbed a “financial renaissance.” DeFi promised endless opportunities in yield farming, staking, and liquidity pooling, all wrapped in the revolutionary idea that finance itself could be reimagined.

The energy was infectious. Barriers seemed to melt away, and users dove headfirst into a world of possibilities. Some chased returns that once felt like dreams, while others were driven by a shared ideal of financial independence. DeFi Summer felt like it would last forever — a season of growth and freedom that couldn’t possibly end.

The Collapse

The ambitious energy that powered DeFi Summer eventually became its undoing, as projects found themselves riding the high of rapid growth without a safety net. Hundreds of millions were siphoned off in hacks; private keys were swiped as easily as candy from a baby, and unwitting users were lured into scam sites, chats, and worse. Projects cannibalized each other’s liquidity, price manipulation became a spectator sport, and poorly designed mechanisms collapsed as soon as token prices took a nosedive.

What went wrong?

First, there was a stunning lack of accountability. The absence of transparent leadership made it all too easy for founders to disappear, taking funds — and faith in the system — with them. Limited technical expertise added fuel to the fire; buggy code created a revolving door of security breaches, costing investors millions. Risk management, meanwhile, was nearly non-existent, with projects crumbling under market pressure and losses stacking up faster than solutions.

Then there was the liquidity issue. Severe slippage turned trades into frustrating experiences, limiting the practical value DeFi was supposed to deliver. Liquidity wasn’t pooled to stabilize markets but was fragmented across various projects, highlighting inefficiencies and making the system look like a sieve rather than a solid foundation.

Lastly, the knowledge gap left many newcomers lost at sea. Complex terminology and layered mechanics made DeFi feel like an insiders’ club. Retail investors, drawn by the siren song of high yields, waded into high-risk waters without a real understanding of the dangers. High returns sounded great — until they realized the risks were just as high, and losses piled up faster than any gains.

The Survivors

While many projects went up in smoke, a few managed to adapt, evolve, and endure. These were the “survivors,” projects that sidestepped extinction by transforming their architecture into something more advanced and adaptable. Builders realized that values like security and transparency weren’t just nice-to-haves; they were lifelines, essential for keeping users loyal through the storms. By listening to user needs and blending sustainable models with solid governance, these survivors showed they had what it took to weather the DeFi reckoning.

For DeFi to be sustainable, it needs to become accessible for widespread adoption. This means it must deliver the same level of security and regulatory compliance that of TradFi. Institutions aren’t interested in taking on avoidable risks — they need infrastructure that minimizes operational risks and optimizes capital efficiency. In response, DeFi protocols have had to enhance their algorithms to maximize returns while being capital-efficient, meeting the high standards set by institutional investors.

Custody solutions, SDKs, APIs — these are the new essentials, turning DeFi into something polished and accessible. Expert insights are becoming the backbone of policies that align with institutional standards, adding a layer of credibility that DeFi couldn’t capture before. Gone are the days of wild experimentation — DeFi is getting dressed up for a more sophisticated crowd.

Enter liquid staking derivatives: they unlock the value of staked assets, making capital more flexible and DeFi far more attractive to institutions. Uniswap v3 — the concentrated liquidity is another nod to efficiency, aligning perfectly with the capital-efficient strategies that market makers rely on.

Then there’s modular customization, with protocols like Morpho Blue allowing DeFi to shape itself around specific institutional needs. This adaptability is vital for DeFi’s next chapter, making it possible to cater to complex requirements while preserving the agility that made DeFi thrilling in the first place.

The New Guards

As DeFi evolves with advanced tools and strategies, professional expertise has become essential. These expert groups, many with roots in TradFi, don’t just fine-tune protocols or stabilize liquidity — they provide a safety net for users. By unlocking DeFi’s full potential, they’re not only optimizing the present but also laying the groundwork for its next big leap: mass adoption.

Liquidity Layer: Ensure a robust liquidity foundation, enabling smooth transactions and market stability.

Liquid Funds: Provide steady capital flow to maintain stable liquidity during market fluctuations.

Market Makers: Ensure smooth trading and price stability by balancing buy and sell orders.

On/Off Ramps: Facilitate seamless transitions between fiat and crypto for easier access and usability.

Technical Layer: Streamline operations, making DeFi accessible, efficient, and institution-ready.

DeFi Integrators & Custodians: Enable secure infrastructure and connectivity for institutions to interact with DeFi protocols.

Tokenization Platforms: Bridge traditional assets to blockchain by converting them into digital tokens for DeFi use.

Portfolio Management Platforms: Offer tools to track, analyze, and optimize investments in DeFi ecosystems.

Governance & Regulatory Layer: Aligning innovation with governance and compliance, DeFi gains trust and long-term sustainability.

Research Groups: Provide data-driven insights to guide risk management and protocol optimization.

RegTech Providers : Ensure compliance with global standards (ie. KYC/AML) while maintaining DeFi’s operational integrity.

Compliance Consultants: Help protocols navigate complex regulations, reducing legal and reputational risks.

Shaping the Future of DeFi

By all accounts, TON is the blockchain closest to achieving mass adoption, a claim already proven by successful tap-to-earn games that have drawn huge numbers of users unmatched by other chains. Yet TON’s DeFi ecosystem is still in its infancy, largely due to a different development environment than the Ethereum DeFi ecosystem: the TON Virtual Machine (TVM). Unlike Ethereum’s EVM, TON doesn’t have a wealth of DeFi precedents to reference or an array of supporting tools, making ecosystem development a more challenging journey.

But juniors can learn from their seniors. TON has the advantage of hindsight, allowing it to sidestep some of the pitfalls that plagued DeFi in the early days. Liquidity issues can be avoidable. Builders can borrow from well-studied, battle-tested designs from EVM and present users with protocols that are not only more efficient but also more robust. With a built-in audience from Telegram, TON DeFi have a unique chance to tackle real-world financial problems for everyday users instead of creating flashy tools for DeFi speculators.

EVM ecosystems, having matured ahead in DeFi, offer a blueprint for the advanced models that TON builders should aim to adopt. Innovations such as isolated pools, undercollateralized lending, and concentrated liquidity have the potential to transform TON’s financial offerings. Additionally, features like optimized yield vaults, modular structures for tailored asset management, and the integration of deep liquidity from BTC and Real-World Assets (RWAs) are key to TON’s ambitious vision. Together, these advancements promise to deliver a DeFi experience that is both robust and uniquely user-centric, paving the way for TON to redefine decentralized finance.

For TON users, this next-generation DeFi landscape offers real, tangible benefits:

Lending with Limited Risks: New lending models prioritize user security while unlocking fresh opportunities.

Enhanced Capital Efficiency: Tools like concentrated liquidity and undercollateralized lending make capital work harder for the user.

Yield Optimization: Vaults and customized asset management help maximize returns while minimizing effort.

Expanded Opportunities: Connecting with BTC and RWA liquidity opens diverse investment options and enhances financial utility for users.

Allies for Growth

For DeFi protocols to reach their full potential and deliver value to users, they need more than just enhanced algorithms. It’s the coordinated participation of diverse institutions — each fulfilling their role and working in harmony — that enables the high-quality, reliable services users expect. Only through this collaborative effort can TON DeFi achieve sustainable growth.

Projects:

Projects within the TON ecosystem are expected to take a collaborative approach to drive long-term growth. By establishing mutual liquidity incentives, teams can bootstrap liquidity and boost user engagement. Open-source contributions are also a priority, allowing developers to continually refine code quality and build trust among users. This transparent, shared approach empowers the community, ensuring that TON grows in both functionality and reliability.

Liquid Funds & Market Makers:

For DeFi to work at scale, reliable infrastructure is key. Liquid funds and market makers play a crucial role here, providing liquidity support to bolster TON ecosystem. Through tools like SDKs, the database, and trading solutions, teams can enhance traders’ experience, making it easier for market makers to enter the TON ecosystem. By anchoring TON’s capital flow, these allies help create a smoother, more stable experience for everyone involved.

Custodian & Tokenization Platform:

Custodian and tokenization refers to the process of storing and verifying institutional holdings of both traditional assets (e.g., real estate, bonds, or commodities) and digital assets like BTC, enabling their integration into DeFi. By addressing compliance requirements and providing technical connections to DeFi, these players facilitate the flow of institutional liquidity into TON ecosystem. This creates access to more stable and diversified investment opportunities for TON users, including BTCfi and RWAs.

Risk Advisors:

Financial experts provide advisory services that not only guide projects in risk management but also educate users on better investment strategies. These advisors offer insights that protect participants from common pitfalls and can even recommend guided investment products tailored to user needs. By helping teams make informed decisions and empowering users with knowledge, risk advisors bring professionalism and foresight to the ecosystem, promoting safe and sustainable growth. For investors, this means a DeFi environment where risks are acknowledged, managed, and complemented with informed investment opportunities.

Together, these allies are building a TON ecosystem that doesn’t just grow — it grows smartly, sustainably, and in a way that’s accessible to all. Through collaboration and diversified support, TON’s DeFi ecosystem stands poised to take on the future with a foundation that’s as solid as it is ambitious.

Perfecting the DeFi Vision

We examined the history of DeFi to understand what TON needs to do not just to survive, but to thrive. Just as TON’s journey hasn’t been easy, DeFi’s growth hasn’t come cheaply. After a careful study of what it takes to reshape the financial system, we realized that relying solely on our own strength or foundation-led incentive programs won’t achieve the sustainable growth we envision. Broad institutional engagement is essential, and only by working together can we truly transform the financial industry.

Some may worry that involving institutions could compromise DeFi’s core principles, such as decentralization and accessibility, pulling it toward centralization. However, the strength of blockchain lies in its inherent trustless nature — it doesn’t rely on the goodwill of any single entity. Institutions entering DeFi are held to the same foundational standards: they must operate transparently, ensuring their actions are visible and justifiable. Moreover, participants with governance power are vital in upholding these principles, actively monitoring and demanding accountability to guarantee that institutions fulfill their responsibilities without undermining DeFi’s decentralized ethos.

It’s the people who bring transparency, accountability, and the spirit of decentralized control to DeFi. In the TON ecosystem, this means existing protocols, newly-come institutions, and informed TON users working together to uphold these core principles. This collaboration strengthens DeFi’s foundational philosophy and ensures its long-term resilience. As DeFi evolves, its future will rely on protocols driving innovation, institutions providing stability, and users fostering informed participation. By building a market rooted in openness, competition, and cooperation, TON can create an ecosystem that honors its ideals while unlocking new opportunities for all.

Let’s grow together and shape a future where DeFi truly thrives.