Affluent's Strategy Vault Brings Trustless Asset Management to the Next Frontier

How Affluent is merging Real-World Assets and Smart Contracts to unlock sustainable, transparent DeFi infrastructure

From Fragility to Foundation in DeFi

In its earliest form, DeFi promised a world without middlemen, where smart contracts would autonomously manage value, and users retained full control. But with time, many protocols fell into familiar traps: chasing unsustainable yields, relying on short-term farming incentives, and collapsing under market volatility. The result? A landscape where complexity reigns and trust remains a silent prerequisite.

Affluent is breaking from that mold. With its newly introduced Strategy Vault, Affluent builds the infrastructure for a future where yield is not only optimized but trustlessly secured. By combining the rigor of traditional asset management frameworks with the transparency and programmability of DeFi, Affluent sets a new precedent: sustainable finance, embedded in code, not trust.

Limitations of Existing Yield Protocols

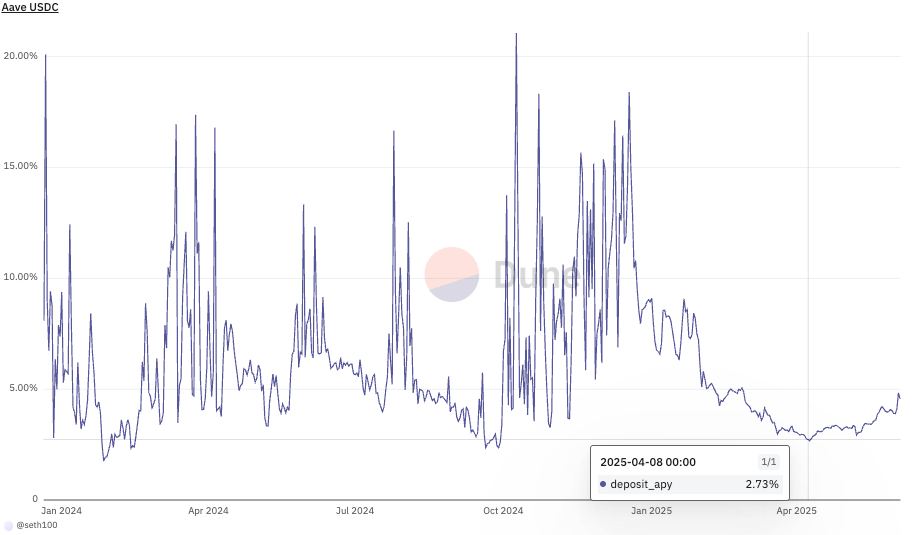

Current DeFi vaults typically involve simple comparisons of returns across single or multiple lending protocols. While these vaults can deliver attractive yields during market peaks, returns quickly diminish in periods of lower demand, often leading protocols to resort to unsustainable farming incentives. Such a model lacks long-term economic sustainability and ultimately fails to consistently attract or retain users.

To address this volatility and economic inefficiency, Affluent introduces a Strategy Vault designed to stabilize yields by integrating Real-World Assets (RWAs), such as Treasury bills, to absorb idle liquidity during low-demand periods. This guarantees users a minimum lending rate while exposing vault operations to new risk dimensions. Unlike competitors using custodial solutions (e.g., Ethena), Affluent achieves this in a fully non-custodial manner, upholding the core principles of DeFi.

Affluent’s Strategy Vault

Affluent want to achieve the following two objectives with Strategy Vault:

Deliver a fully comprehensive Trustless Asset Management to users

Maximize user convenience and accessibility

Achieving Trustless Infrastructure

Traditionally, financial asset management necessitates substantial trust between investors and fund managers. Investors must trust managers to prioritize investor interests, manage risks diligently, and report transparently. Despite stringent legal frameworks, traditional financial systems still experience inefficiencies and incidents.

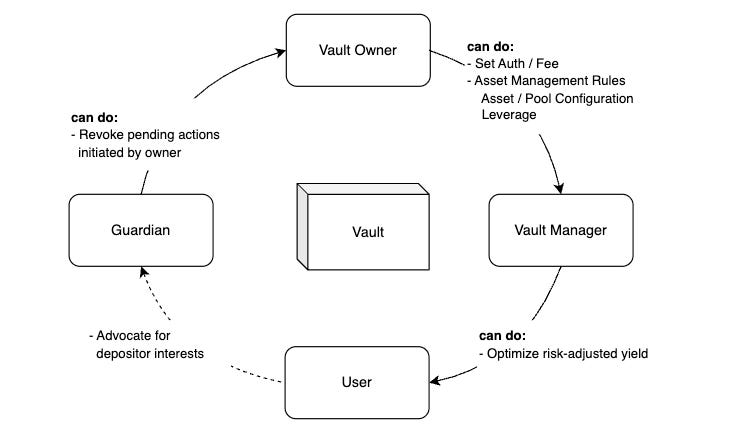

Affluent eliminates the reliance on trust by embedding transparent and enforced governance directly into the protocol’s smart contracts:

Manager Oversight: Manager actions are strictly governed by owner-defined investment policies coded directly into smart contracts. Managers are limited to interactions with authorized pools and specific whitelisted assets, structurally preventing unauthorized asset withdrawals or misuse of funds.

Owner Oversight: Changes to investment strategies or policies proposed by the owner are subject to a mandatory time-lock delay. During this period, a designated guardian can review and revoke the changes if they pose risks or deviate from original commitments, ensuring stability and continuity.

Operational Safety: All asset transactions and interactions with external protocols other than Affluent is tightly regulated. Only pre-approved asset pairs are swapped and executed exclusively via the RFQ (Request-for-Quote) mechanism, allowing market makers to settle the transaction within preset price boundaries, significantly reducing operational risk.

Users can confidently deploy liquidity knowing all transactions and strategy changes are transparent and pre-announced, enabling them to exit before changes occur. Advanced risk frameworks ensure leveraged strategies remain capital-efficient and secure.

UX Abstraction for Enhanced Accessibility

DeFi's growth faces obstacles such as structural risks, high volatility due to shallow liquidity, overly complex investment processes, and reliance on unsustainable incentives. Affluent’s Strategy Vault addresses these challenges by combining human expert oversight with simplified, automated investment solutions, leveraging deeper liquidity pools from Real-World Assets (RWAs), BTC, and Gold. Inspired by stablecoin market success, Affluent emphasizes stable, sustainable yields, convenient tokenized access, and broad financial inclusion.

Affluent’s Strategy Vault lowers barriers for users and provides one-click access to a wide range of investments:

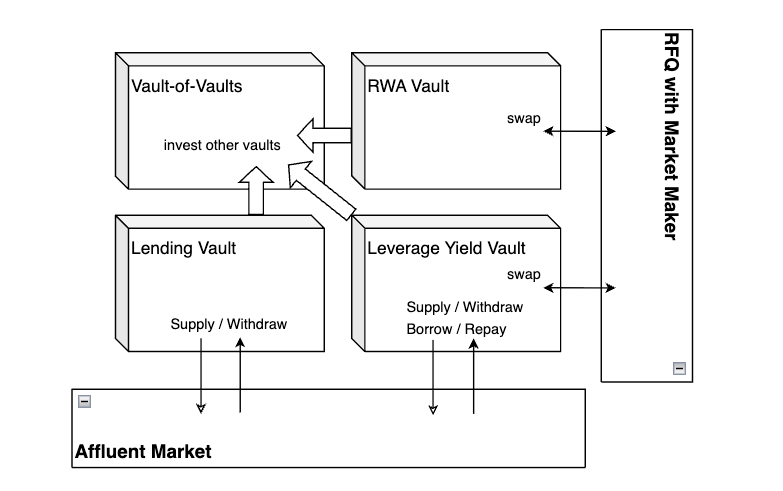

Lending Vault: Automates risk-adjusted yield optimization by systematically allocating user assets across the most beneficial lending pools, ensuring optimal returns relative to risk.

Real-World Asset Integration: Expands investment scope to include stable, yield-generating real-world assets like Treasury bills and corporate credits, delivering predictable and consistent returns even in fluctuating market conditions.

Leveraged Yield Strategies: Enables advanced strategies such as looping of Liquid Staking Tokens (LST) for amplified returns, leveraging structured borrowing capabilities to boost yields safely.

Fund-of-Funds: Aggregates multiple strategies and asset classes into a unified investment product, managing comprehensive risk and maximizing returns.

Vault Managers meticulously evaluate and manage each strategy, continuously optimizing risk-adjusted returns within a pre-defined range of operations.

Affluent’s Strategy Vault provides straightforward, secure access to diverse investment opportunities, eliminating the complexity associated with DeFi:

Robust accessibility via deeply liquid markets suitable for extensive user bases.

Inflation-resistant investments (Gold, BTC) combined with reliable yield opportunities.

Simplified and accessible USD savings are particularly beneficial for users in emerging economies.

Transparent and secure non-custodial management, significantly reducing reliance on traditional financial institutions.

Final Words

Affluent’s Strategy Vault embodies the democratization of finance by merging expert human oversight and innovative technology in a trustless infrastructure.

It overcomes traditional financial constraints, delivering superior, secure, and inclusive financial services. By systematically enhancing DeFi accessibility through trustless asset management, diverse product offerings, and user-friendly distribution channels, Affluent empowers users to navigate financial markets confidently, addressing real-world economic challenges transparently and sustainably.

Built by Affluent.

Website | App | X | Telegram (Announcement) | Telegram (Community) | Docs | Blog | Linkedin