Affluent Vault Performance Report - August '25

A closer look at Ethena Multiply Vault: sustainable growth through leveraged strategies.

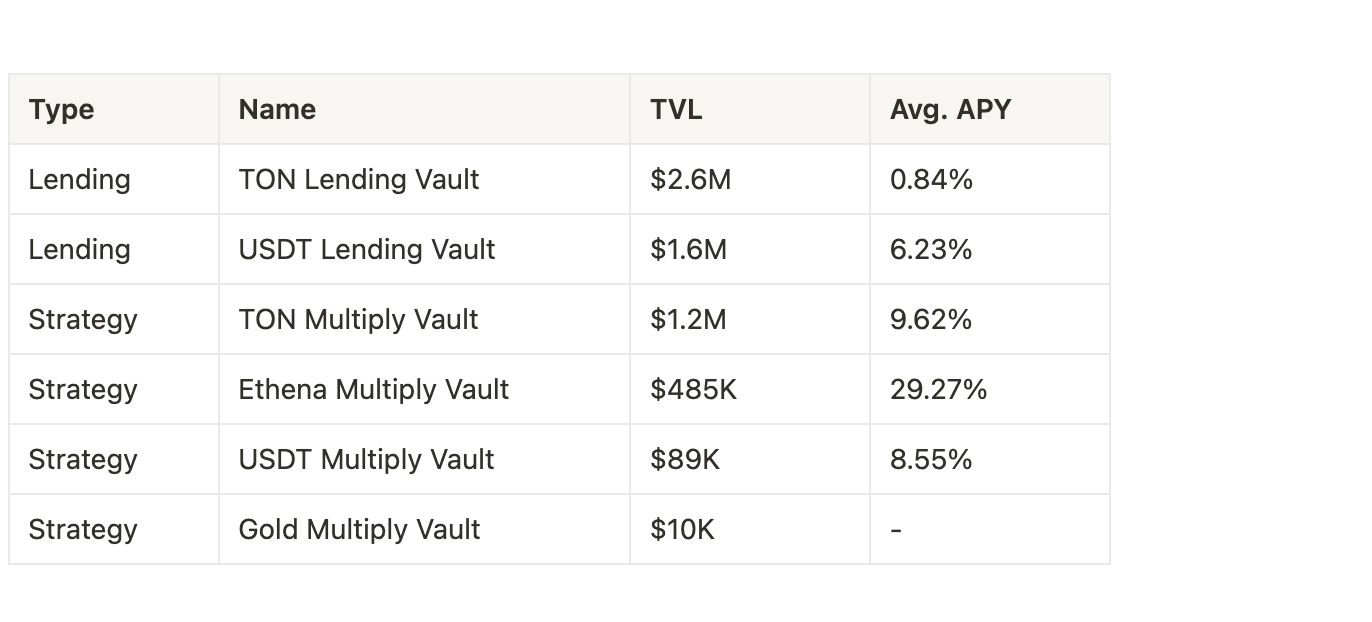

Affluent currently offers six vaults and plans to steadily expand its range of underlying assets and strategies.

Average APY is annualized based on yields accrued during August 2025.

The Lending Vaults, available for TON and USDT, allocate liquidity across multiple markets, factoring in collateral risks and market demand. These vaults are designed for low-risk investors, such as whales or institutions, seeking stable returns.

The Strategy Vaults primarily employ a looping strategy, which involves borrowing assets against collateral to capture the spread between borrowing and lending rates. These vaults appeal to investors willing to take on higher risks for potentially greater rewards.

New Strategy Vault

In August 2025, Affluent launched the Gold Multiply Vault following the introduction of Tokenized Gold (XAUt0) on TON. Gold has long been regarded as a safe-haven asset and an effective hedge against inflation, making it a recommended addition to any investor’s portfolio, especially in volatile times. XAUt0, issued by Tether, the leading stablecoin issuer, offers a more efficient and accessible way to invest in gold. Affluent’s Gold Multiply Vault builds on this by combining gold exposure with a yield-generating looping strategy, enabling investors to benefit from both asset appreciation and enhanced returns.

Deep Dive into Ethena Multiply Vault

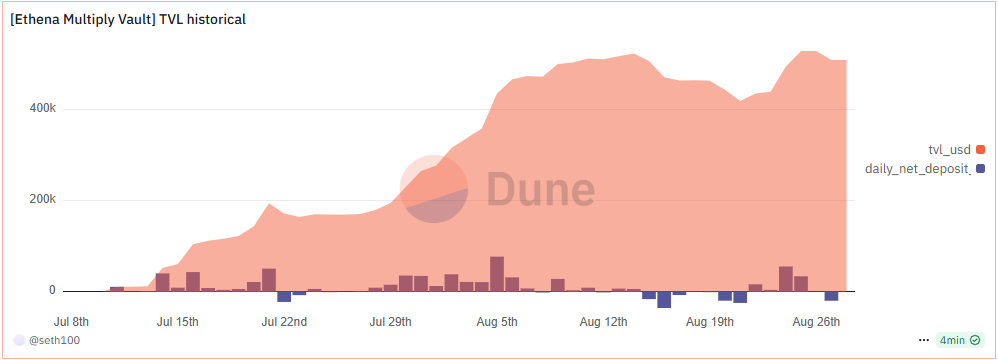

The Ethena Multiply Vault is a leveraged strategy centered on USDe, a synthetic dollar stabilized through delta-neutral hedging. Its staked variants include sUSDe, which distributes profits to holders, and tsUSDe, a TON-native staked version of USDe with slight variations. Launched in July 2025, the Ethena Multiply Vault quickly became Affluent’s fastest-growing vault, attracting $500K in stablecoin deposits within its first month.

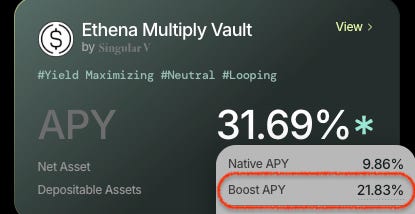

Currently, tsUSDe holders benefit from additional incentives provided by the TON Foundation. For holdings up to 10,000 tsUSDe, the Foundation directly deposits TON equivalent to a 10% APY boost into users’ wallets. This incentive applies not only to tsUSDe held directly but also to amounts supplied to Affluent’s market or held in the Ethena Multiply Vault. As a result, users can enjoy a leveraged, boosted APY by participating in this vault.

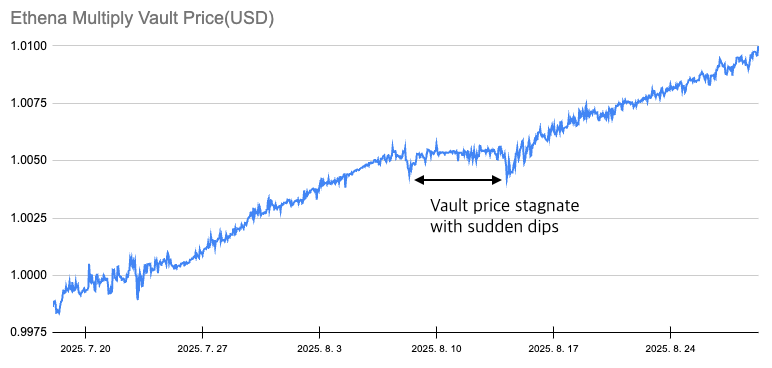

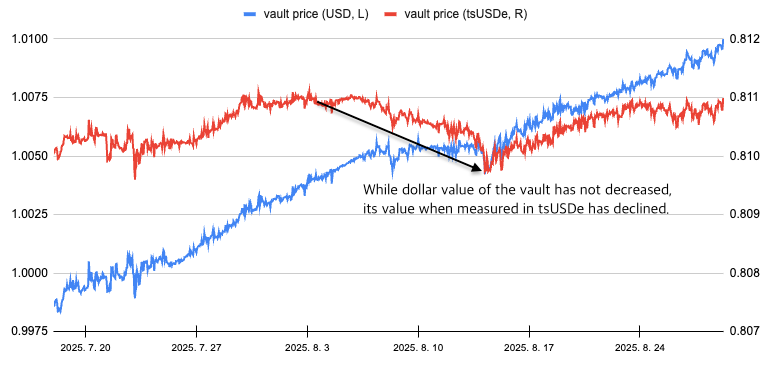

Despite its rapid growth, the Ethena Multiply Vault experienced a brief period of price stagnation in the second week of August 2025, with notable dips and recoveries surrounding this period. This volatility prompted several user inquiries regarding yields. Below, we provide a detailed explanation to address these concerns.

Performance Analysis

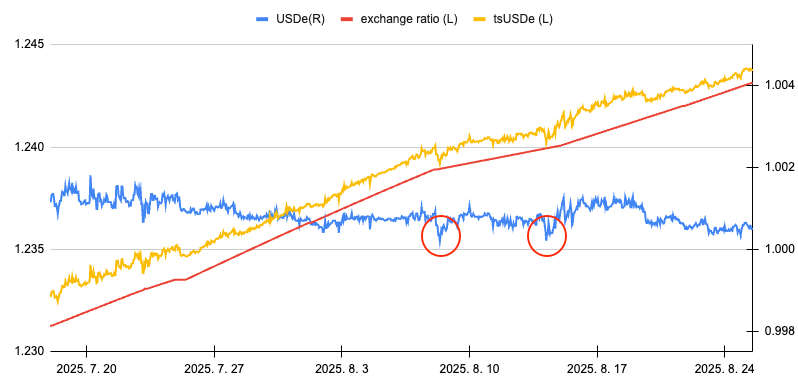

1. USDe price fluctuations

To avoid the low liquidity and high volatility of tsUSDe’s DEX price, which could trigger unnecessary liquidations, the vault calculates its price using a more stable method. The price is derived by multiplying the USDe price, sourced from deep-liquidity DEX like Curve and Uniswap, by the tsUSDe/USDe exchange ratio obtained from Ethena’s smart contract. While this approach enhances price reliability for tsUSDe, it does not fully shield the vault from USDe’s inherent price volatility.

As shown in the charts, USDe is not perfectly pegged to $1 and experience slight fluctuations. On August 8, it experienced a notable drop of about 7 basis points, roughly equivalent to the daily yield of the Ethena Multiply Vault (30% ÷ 365 ≈ 0.082%). Although it quickly recovered, another dip of approximately 5 basis points occurred on August 14. Such sudden drops directly impact the vault price.

2. Negative Yield-Borrow Rate Spread

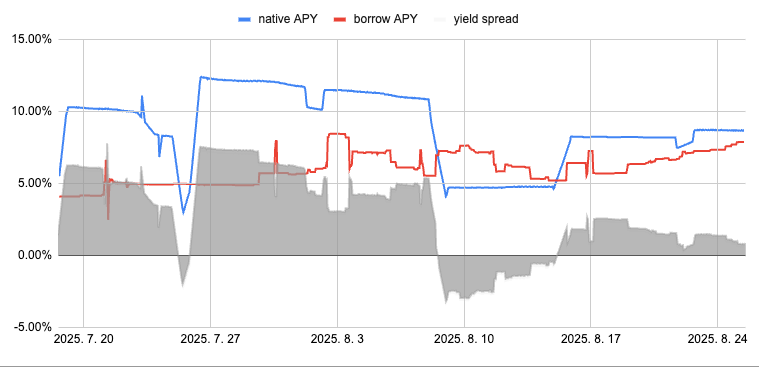

TON Foundation offers a 10% APY TON incentive to tsUSDe holders, but this reward is paid directly to users’ wallets and does not accrue to the vault itself. As a result, the vault cannot benefit from this boosted yield. From August 7 to 14, tsUSDe yields dropped below 5%, while USDT borrowing rates on the Ethena Market climbed to 8%, resulting in a negative yield-borrow rate spread.

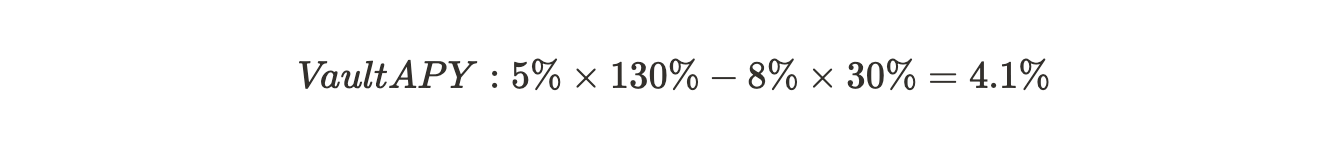

During this period, the vault operated with approximately 130% leverage (borrowing USDT equivalent to 30% of the TVL). The vault’s APY can be calculated as follows:

This APY reflects the vault’s yield without the TON Foundation’s incentive boost. When users evaluate the vault’s value based solely on the number of tsUSDe tokens, periods of negative spread can lead to a decline in perceived value, which was unexpected for many investors.

Final Thoughts

The Ethena Multiply Vault is designed to amplify returns by leveraging TON Foundation’s APY boosts. While internal losses may occur, the leveraged farming incentives typically outweigh these, benefiting users. On the Earn page, the vault’s displayed yield includes the portion boosted by these incentives.

However, the unexpected decline in vault value caught some users by surprise. In hindsight, Affluent recognizes the need for clearer, proactive communication regarding these dynamics and acknowledges this oversight.

Trustless Design: Security and Transparency

During periods of perceived underperformance, such as the one in August 2025, it’s natural for investors to feel concerned about potential losses. However, the vault’s trustless design ensures that no one, not even the manager, can act arbitrarily or interfere with your assets. Operations are governed by strict smart contract rules, which enforce predefined parameters like asset allocations, investment caps, and slippage tolerances. This decentralized structure means you don’t need to place trust in any individual or entity; the system itself protects depositors’ funds through transparent, code-enforced mechanisms.

Risks of Leveraged Strategies

While the trustless design ensures security, leveraged vaults like the Ethena Multiply Vault carry market-driven risks. Rising borrowing rates, as observed in August 2025, potential USDe depegging, liquidity constraints, and smart contract vulnerabilities can impact performance. These risks highlight the trade-off of pursuing higher returns with increased exposure to volatility. Investors should carefully evaluate their risk tolerance and consider diversification.

Moving Forward

Affluent acknowledges that the unexpected value decline in August 2025 caught users off guard and recognizes the need for clearer communication. Going forward, we are committed to improving transparency through better updates on market dynamics and vault performance. Thank you for your trust and feedback, we’re focused on making the Ethena Multiply Vault a more reliable and rewarding option for all users.

Website | App | X | Telegram (Announcement) | Telegram (Community) | Docs | Blog | Linkedin |